Speak To Our Experts

Low-Cost, Reliable Coverage to Protect What Matters Most

“Richey Insurance Agency works for you, not just one insurance agency!”

Trustindex verifies that the original source of the review is Google. Harold has been such a great resource! He has answered all of my questions and helped ensure that I get the best insurance rate.Posted onTrustindex verifies that the original source of the review is Google. Everyone listen to my questions and worked to get me what I wanted.Posted onTrustindex verifies that the original source of the review is Google. I called today and spoke with Jeesril to confirm information about my automobile coverage. He was very professional, knowledgeable and helpful. He explained to me why the company name had changed and when my next bank draft would be due. I feel very comfortable with the interaction I had with him today and would recommend Richey Insurance Agency to anyone in need of insurance.Posted onTrustindex verifies that the original source of the review is Google. I appreciate the assistance provided by Wincy @Richey Insurance in setting up my auto and home renewals. What draws me to recommend him for your needs is his dedication to go above and beyond in finding the best premiums for your needs without compromising coverage.Posted onTrustindex verifies that the original source of the review is Google. I’ve talked with Darren and Radali. Both are amazing, they listen and find the best insurance policy that fits you… 100% recommended!

It only takes a few moments to complete the form, request a quote now!

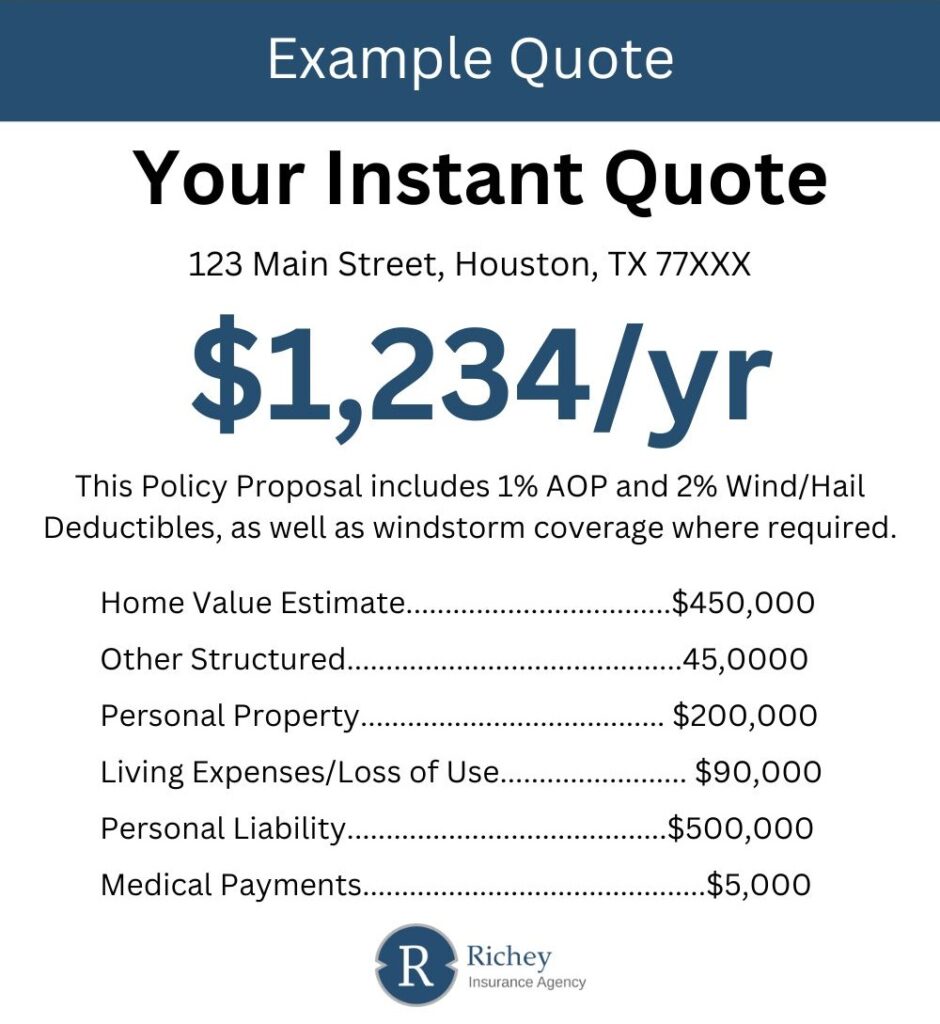

The image provided is a representation of what your quote will look like.

A standard homeowners policy shields more than just the house itself. Here’s a quick guide to what a typical plan covers:

| Coverage Type | What It Protects |

|---|---|

| Dwelling Coverage | Repairs or rebuilds your home after damage from covered risks like fires or storms. |

| Other Structures | Covers things like detached garages, fences, or sheds sitting on your property. |

| Personal Property | Pays for personal belongings such as furniture, clothes, and electronics if they’re stolen or damaged. |

| Loss of Use / Additional Living Expenses | Provides money for hotel stays, meals, and other costs if you need to live elsewhere during repairs. |

| Personal Liability | Helps cover legal fees and damages if someone is hurt on your property. |

| Medical Expenses | Pays for minor injuries to guests without a lawsuit even being filed. |

Strong coverage across these areas helps Kemah homeowners feel confident no matter what the Texas coast throws their way.

Insurance carriers in Kemah review a range of details before offering a quote. Some of the biggest influences include:

Each of these pieces helps paint a full risk profile, shaping what your Kemah home insurance rate will look like.

With Clear Lake, Trinity Bay, and Galveston Bay all nearby—and the Gulf of Mexico just beyond—Kemah faces a steady threat of flooding. Storms like Hurricane Beta, Imelda, and Harvey left devastating impacts across the region, highlighting the real financial risks.

Standard homeowners insurance doesn’t pay for flood damage. To protect your property and possessions from water damage caused by hurricanes, tropical storms, or heavy rain, a separate flood insurance policy is highly recommended. Even a few inches of water can result in tens of thousands of dollars in damages, making flood coverage a wise decision for anyone living along the Texas coastline.

Texas law doesn’t mandate home insurance, but nearly every mortgage lender will require you to carry it. Even for homes without loans attached, a solid insurance plan can save you from footing the bill after unexpected disasters.

Several key elements influence the cost of home insurance, including your home’s age, the building materials used, distance from flood zones, claims history, credit score, and even the type of roof you have. Living near the Gulf Coast also brings higher hurricane and flood risks, which insurers factor into the price.

Homeowners in Kemah should double-check that their policy includes windstorm protection for hurricanes. At Richey Insurance Agency, the policies we offer for Texas homeowners come with wind coverage automatically included for your peace of mind.

The HO-3 Special Form Policy remains the most common choice among homeowners. It offers broad protection for the structure of your home and your belongings, covering all risks except those specifically listed as exclusions.

Request a free quote using our convenient online form

Prefer to talk to a representative? Our agents are more than happy to help you.

You are welcome to visit our office. We are open Monday - Friday (8 am - 5 pm)