Speak To Our Experts

Smart, Custom Coverage Backed by 100+ Trusted Insurers

“Richey Insurance Agency works for you, not just one insurance agency!”

Trustindex verifies that the original source of the review is Google. We have worked with this insurance company for over 10 years. They have consistently provided reliable coverage, responsive service, and clear guidance when we’ve needed it most. We appreciate the long-term relationship and professionalism.Posted onTrustindex verifies that the original source of the review is Google. Mr. Paul was very helpful in meeting my insurance needs. Also their price was less than what was quoted by other agentsPosted onTrustindex verifies that the original source of the review is Google. Respectful and courteous! Meets all demands and questions. Very cooperative. Paul is very easy to work with. Thank you guys!Posted onTrustindex verifies that the original source of the review is Google. Paul was very kind and very helpfulPosted onTrustindex verifies that the original source of the review is Google. Richey Insurance is the best!!!Posted onTrustindex verifies that the original source of the review is Google. Great service

It only takes a few moments to complete the form, request a quote now!

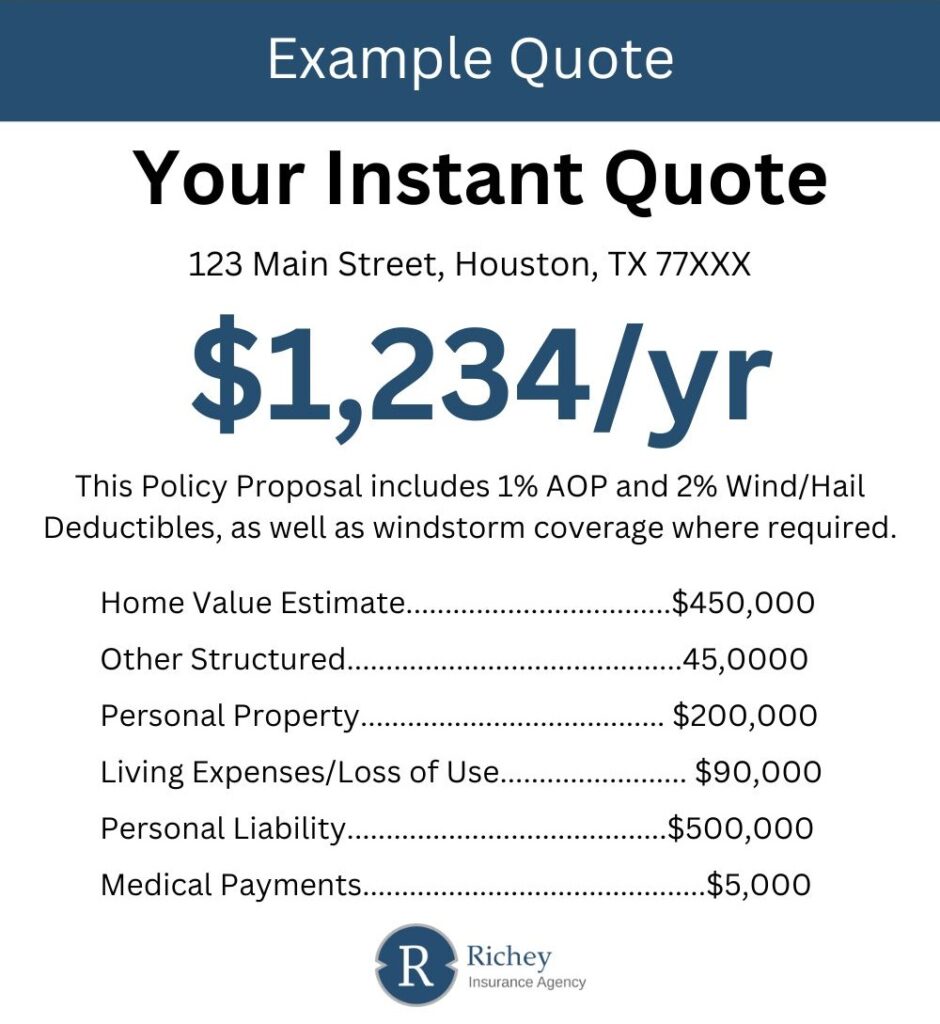

The image provided is a representation of what your quote will look like.

Living in Grand Prairie means facing unpredictable weather and a mix of natural and man-made risks. A well-built home insurance policy helps shield your property and belongings from damage caused by everything from storms to theft. Richey Insurance Agency partners with over 100 reputable carriers to help Grand Prairie homeowners find affordable, tailored protection that matches local conditions.

Fire

Accidental fires, lightning strikes, or nearby structure fires can cause severe damage. A home insurance policy helps pay for repairs to your home’s structure and personal items damaged by flames, smoke, or water used to put out the fire.

Floods

Many Grand Prairie neighborhoods are built on or near flood plains. The city estimates that over a 30-year mortgage period, a home in this area has roughly a 30% chance of a major flood. While standard home policies exclude flood coverage, a separate flood insurance policy can safeguard your property against rising waters and drainage backups.

Heat

Summers in Grand Prairie often reach the mid-90s, and extended heatwaves can lead to power outages, HVAC strain, or damage to home systems. Adding service line coverage or equipment breakdown protection may help offset the cost of repairs to appliances and electrical systems.

Tornadoes and Storms

High winds, hail, and flying debris pose significant threats during tornado season. Standard homeowners policies usually cover wind and hail damage, but it’s important to review your policy limits and deductibles especially if your insurer separates windstorm coverage into a different category.

Theft and Vandalism

Property crime rates in Grand Prairie hover around the national average. Home insurance provides financial protection if your belongings are stolen or your property is damaged due to a break-in. Installing security systems or smart home devices may qualify you for premium discounts.

A typical policy includes coverage for your home’s structure, personal belongings, detached buildings, liability for injuries or property damage, and additional living expenses if you need to stay elsewhere during repairs after a covered loss.

Homes here often experience wind and hail damage, lightning, and occasional flooding. Wind and hail are usually covered in a standard policy, but flood insurance must be purchased separately.

Premiums have risen due to higher rebuilding costs, inflation, and frequent storm-related claims in North Texas. Comparing quotes from multiple carriers helps find the best value and coverage match.

Yes. Many insurers offer savings for bundling home and auto policies, adding monitored security systems, upgrading roofs, or keeping a claim-free record.

Most standard policies exclude foundation issues caused by settling or drainage problems. However, if the damage results from a covered event like a burst pipe or explosion some costs may be reimbursed.

Request a free quote using our convenient online form

Prefer to talk to a representative? Our agents are more than happy to help you.

You are welcome to visit our office. We are open Monday - Friday (8 am - 5 pm)