Speak To Our Experts

Custom, Affordable Protection Matched from 100+ Top Carriers

“Richey Insurance Agency works for you, not just one insurance agency!”

Trustindex verifies that the original source of the review is Google. Harold has been such a great resource! He has answered all of my questions and helped ensure that I get the best insurance rate.Posted onTrustindex verifies that the original source of the review is Google. Everyone listen to my questions and worked to get me what I wanted.Posted onTrustindex verifies that the original source of the review is Google. I called today and spoke with Jeesril to confirm information about my automobile coverage. He was very professional, knowledgeable and helpful. He explained to me why the company name had changed and when my next bank draft would be due. I feel very comfortable with the interaction I had with him today and would recommend Richey Insurance Agency to anyone in need of insurance.Posted onTrustindex verifies that the original source of the review is Google. I appreciate the assistance provided by Wincy @Richey Insurance in setting up my auto and home renewals. What draws me to recommend him for your needs is his dedication to go above and beyond in finding the best premiums for your needs without compromising coverage.Posted onTrustindex verifies that the original source of the review is Google. I’ve talked with Darren and Radali. Both are amazing, they listen and find the best insurance policy that fits you… 100% recommended!

It only takes a few moments to complete the form, request a quote now!

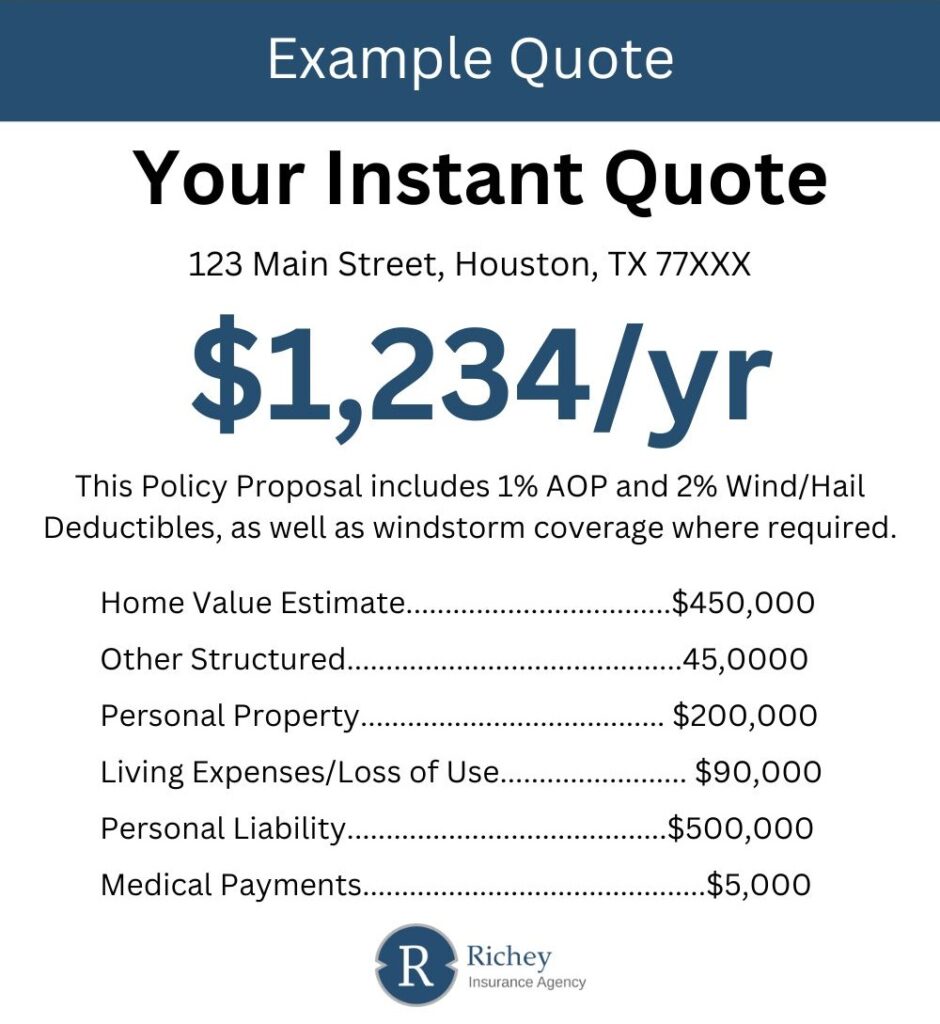

The image provided is a representation of what your quote will look like.

Homeowners insurance is designed to help you recover financially after damage to your property or personal belongings. Several factors influence how your premium is calculated, and knowing what affects your rate can help you make cost-effective coverage decisions.

The level of protection you choose plays a major role in your premium. Higher coverage limits generally result in higher costs, but they also provide stronger financial protection. Richey Insurance Agency compares policies from over 100 trusted carriers to help you find a plan that balances coverage and price effectively.

Homes in Friendswood may face elevated premiums due to Gulf Coast weather exposure. Areas prone to flooding, hurricanes, or higher crime rates usually present greater risk, which can lead to higher insurance costs.

Your home’s build and upkeep directly affect your premium. Older or poorly maintained homes may cost more to insure because they are considered higher-risk. Size and construction materials also factor into the price larger homes or those built with expensive materials tend to have higher rebuilding costs, which can increase premiums.

A typical policy includes coverage for your home’s structure, detached buildings like garages or sheds, personal belongings, personal liability, and temporary living expenses if your home becomes unlivable after a covered loss.

Friendswood faces risks from Gulf Coast storms, including hurricanes, heavy rainfall, and flooding. These hazards raise the likelihood of claims, resulting in higher average premiums compared to inland areas.

Flood damage is excluded from standard home insurance. Many homeowners in Friendswood purchase separate flood insurance to protect against heavy rain and storm surge common to the region.

Most homeowners in Friendswood choose the HO-3 policy, which covers a wide range of perils for both your home and personal belongings. Many residents add optional protection such as flood, windstorm, or water backup coverage for more complete protection.

Consider increasing your deductible, bundling your home and auto policies, keeping your home well maintained, improving security, or maintaining good credit. Working with an independent agency like Richey Insurance gives you access to multiple carriers so you can compare options and find the best value.

Request a free quote using our convenient online form

Prefer to talk to a representative? Our agents are more than happy to help you.

You are welcome to visit our office. We are open Monday - Friday (8 am - 5 pm)