Speak To Our Experts

Smart Coverage at a Price That Makes Sense – Powered by 100+ Leading Insurance Carriers

“Richey Insurance Agency works for you, not just one insurance agency!”

Trustindex verifies that the original source of the review is Google. We have worked with this insurance company for over 10 years. They have consistently provided reliable coverage, responsive service, and clear guidance when we’ve needed it most. We appreciate the long-term relationship and professionalism.Posted onTrustindex verifies that the original source of the review is Google. Mr. Paul was very helpful in meeting my insurance needs. Also their price was less than what was quoted by other agentsPosted onTrustindex verifies that the original source of the review is Google. Respectful and courteous! Meets all demands and questions. Very cooperative. Paul is very easy to work with. Thank you guys!Posted onTrustindex verifies that the original source of the review is Google. Paul was very kind and very helpfulPosted onTrustindex verifies that the original source of the review is Google. Richey Insurance is the best!!!Posted onTrustindex verifies that the original source of the review is Google. Great service

It only takes a few moments to complete the form, request a quote now!

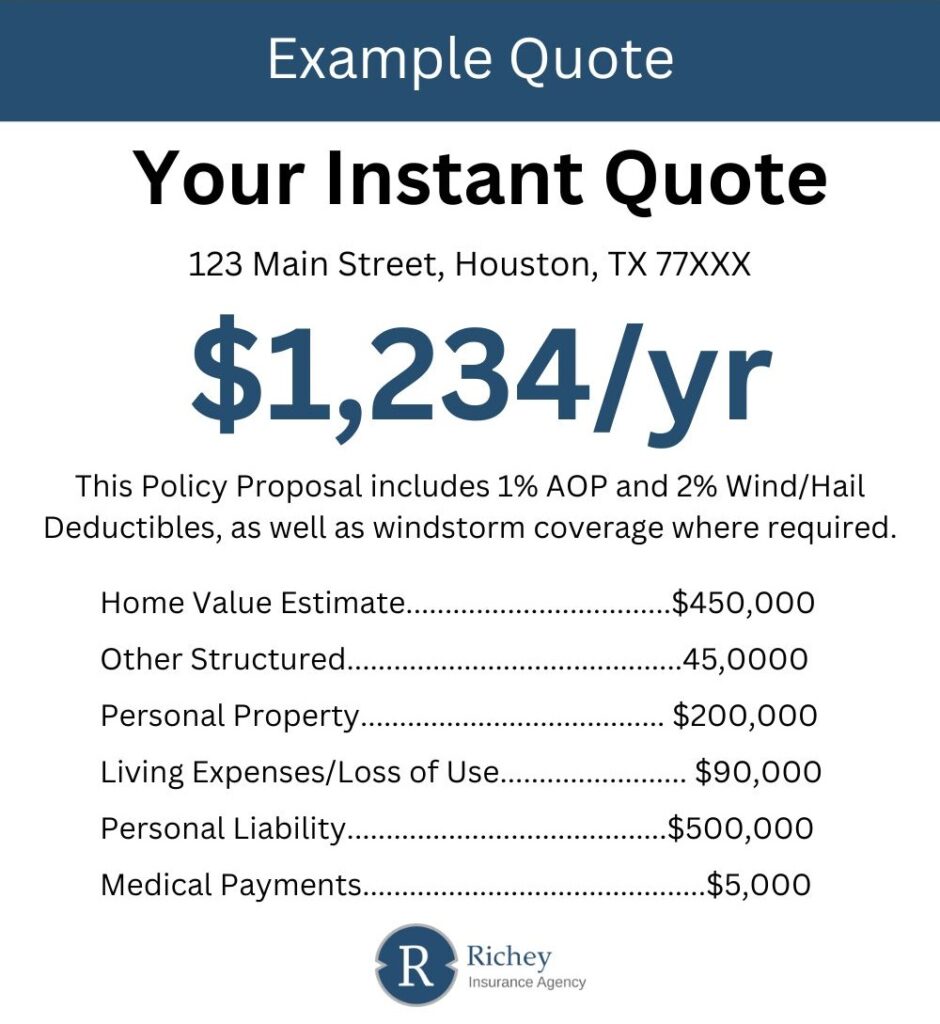

The image provided is a representation of what your quote will look like.

Every Fresno homeowner needs a policy that covers more than just the basics. Here’s a clear breakdown of what’s typically included:

| Coverage Type | What It Protects |

|---|---|

| Dwelling | Covers the structure of your home—walls, roof, foundation. |

| Other Structures | Includes sheds, fences, and detached garages. |

| Personal Property | Protects furniture, clothing, and electronics. |

| Loss of Use / Living Expenses | Pays for hotel stays, meals, and living costs if your home becomes unlivable. |

| Personal Liability | Helps cover legal costs if you’re held responsible for injury or damage. |

| Medical Payments to Others | Pays for minor injuries to guests on your property. |

Each category plays a role in safeguarding different aspects of your home and lifestyle. Together, they form the backbone of a reliable home insurance policy in Fresno.

Flood Insurance – Fresno homes can face flood risks that regular policies won’t cover. Adding this coverage helps protect your home from damage caused by rising water.

Windstorm and Hail Coverage – Weather in Texas isn’t always calm. This add-on helps cover repairs from wind and hail damage, which are common in the region.

Water Backup – A backed-up drain or sump pump can leave behind a costly mess. This coverage steps in to handle the cleanup and repairs.

These additions give your policy more flexibility—especially for the kinds of issues that hit Texas homes hardest.

Insurance isn’t one-size-fits-all, and we don’t treat it that way. Here’s how we make a difference:

We’re based in Texas, we work with Texans, and we make sure your coverage works for your situation—not someone else’s.

Most base policies start at $100,000 in liability coverage. Still, $300,000–$500,000 is often recommended to protect your assets and future earnings from lawsuits.

To receive full claim payouts, your policy should cover at least 80% of the total cost to rebuild your home. If you fall below that threshold, your insurer may only pay part of the damage—leaving you to cover the rest.

A limit sets the highest amount your insurer will pay for a specific type of claim. Every part of your policy—like personal property or liability—has its own limit. It’s worth reviewing them carefully to make sure nothing falls short.

Fresno homeowners have seen prices climb due to more frequent severe weather and rising repair costs. Insurance companies adjust rates based on risk—and in areas with high claims activity, that means higher premiums.

Request a free quote using our convenient online form

Prefer to talk to a representative? Our agents are more than happy to help you.

You are welcome to visit our office. We are open Monday - Friday (8 am - 5 pm)