Speak To Our Experts

Save Up to 40% Per Year on Home Insurance

A strong policy helps safeguard your home in Live Oak from common Texas risks.

We have access to 100+ leading carriers in Texas to find the best insurance for your home and family.

“Richey Insurance Agency works for you, not just one insurance agency!”

Trustindex verifies that the original source of the review is Google. We have worked with this insurance company for over 10 years. They have consistently provided reliable coverage, responsive service, and clear guidance when we’ve needed it most. We appreciate the long-term relationship and professionalism.Posted onTrustindex verifies that the original source of the review is Google. Mr. Paul was very helpful in meeting my insurance needs. Also their price was less than what was quoted by other agentsPosted onTrustindex verifies that the original source of the review is Google. Respectful and courteous! Meets all demands and questions. Very cooperative. Paul is very easy to work with. Thank you guys!Posted onTrustindex verifies that the original source of the review is Google. Paul was very kind and very helpfulPosted onTrustindex verifies that the original source of the review is Google. Richey Insurance is the best!!!Posted onTrustindex verifies that the original source of the review is Google. Great service

Our team is here to guide you throughout the whole process and will help you find the best insurance coverage for your home.

Prefer a face-to-face conversation? Our doors are always open.

Here’s your Google Map guide:

It only takes a few moments to complete the form, request a quote now!

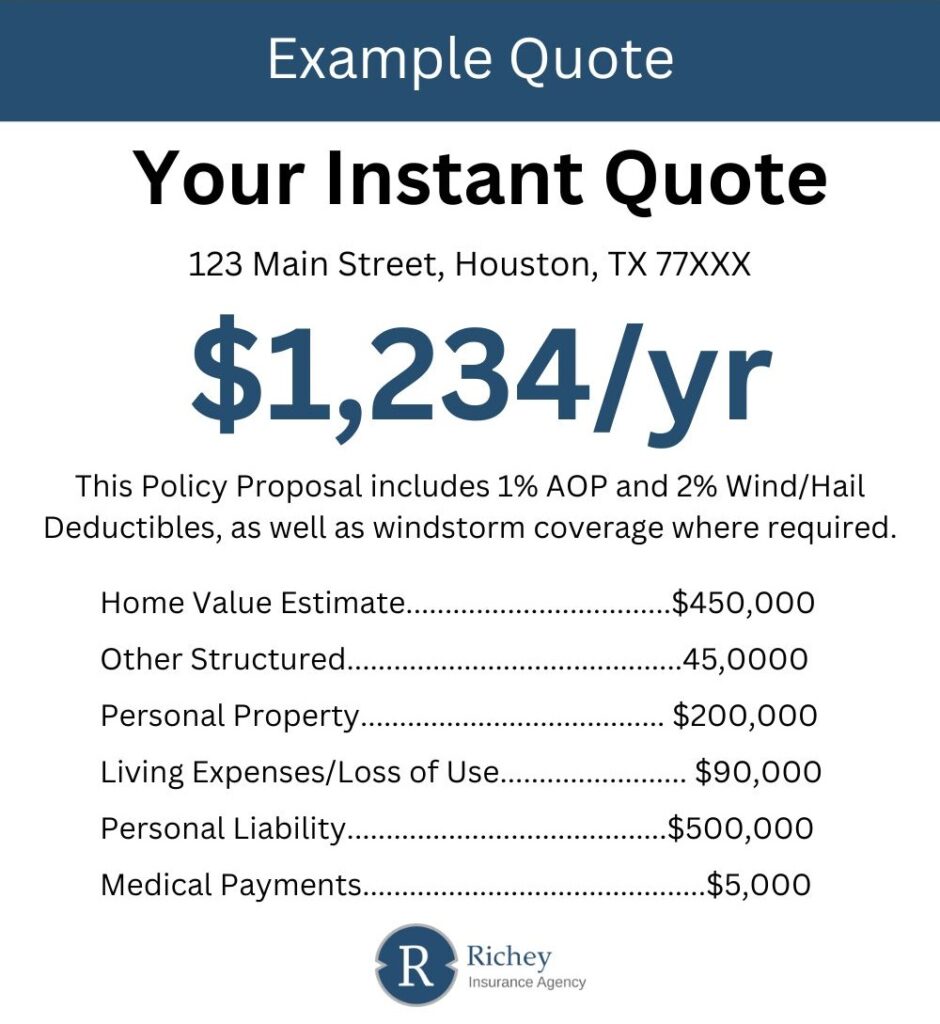

The image provided is a representation of what your quote will look like.

Texas experiences some of the most varied weather conditions in the country. Homeowners in Live Oak face exposure to:

Events like these create sudden and costly damage. A reliable policy helps protect your investment, manage unexpected expenses, and secure your property’s long-term value. Texans often face higher repair bills due to material shortages, rising labor rates, and the overall cost of rebuilding after storms—making strong coverage an important priority.

We’ve seen how quickly a normal day turns into a stressful one after a major storm. Many families reach out to us right after hail or wind has damaged their roof, and the first question is usually, “What do we do now?” Our job at Richey Insurance Agency is to give clear guidance, help them understand their coverage, and support them through each step. That experience shapes the way we help homeowners prepare long before severe weather hits.

Most home insurance policies in Texas include several coverage sections. Each serves a different purpose and supports homeowners through a wide range of scenarios.

Key coverage areas:

Dwelling Coverage

Pays for repairs or rebuilding after damage from covered events.

Liability Protection

Protects against lawsuits for injury or property damage.

Personal Property Coverage

Helps replace furniture, electronics, and other belongings.

Personal Property Coverage

Covers minor injuries to guests, regardless of fault.

Additional Living Expenses

Covers temporary housing costs if the home becomes unlivable.

Other Structures

Covers detached garages, fences, and sheds.

Most policies exclude a few types of damage, so homeowners benefit from knowing what falls outside standard coverage.

Each of these exclusions highlights why additional protection and proper upkeep matter for homeowners in Live Oak. If flood coverage or other add-ons are needed, we guide families through the available options so they can choose protection that matches their home’s risks.

Texas homes experience a wide mix of weather and structural challenges, so many families add extra protection to strengthen their policy. From our experience at Richey Insurance, small upgrades often prevent big financial surprises later on. These are the options we see homeowners in Live Oak choose most often.

Popular add-ons

These add-ons strengthen different parts of a policy and help lower repair expenses when unexpected damage occurs. Our team guides homeowners in Live Oak through each option so they can choose what fits their home best.

Most Texas households fall within a similar price range for home insurance in Texas, and the same range applies to homeowners in Live Oak.

Typical cost range

$1,000 to $3,000 per year for a standard Texas policy

Premiums vary based on factors such as the home’s age, roof condition, coverage limits, and the deductible you choose. Homes in Live Oak generally fit within the same statewide range.

Why do rates differ?

Texas experiences frequent storms, rising construction costs, and steady claim activity, all of which influence pricing in every region.

How does Richey Insurance help reduce costs?

Many homeowners pay more than they need to simply because they never compare options. We often help families lower their premiums—sometimes up to 40% per year—through competitive shopping and coverage adjustments that fit their home more accurately.

Here is a table outlining the most common rating factors seen across Texas:

| Factor | How It Impacts Your Rate |

|---|---|

| Location | Weather exposure, storm frequency, and claim trends in the ZIP code |

| Home Age | Older homes often cost more due to aging materials and older roofing |

| Roof Condition | A newer or well-maintained roof may reduce risk of damage |

| Construction Type | Higher rebuild costs raise premiums |

| Claims History | Prior losses increase the perceived risk to insurers |

| Credit Factors | Lower credit-based insurance scores may lead to higher rates |

| Coverage Limits | Higher limits increase overall premium |

| Deductible Choice | A higher deductible usually lowers the cost |

| Security Features | Alarm systems, cameras, and monitoring services may qualify for discounts |

From our experience, many homeowners in Live Oak are not aware of how strongly these factors affect their premiums. Small updates, such as improving roof condition or adding monitored security, often create meaningful savings.

We review these details with each household so the policy reflects the home accurately and avoids unnecessary costs.

Home insurance varies from one household to another, and our role is to help you find the right level of protection with clarity and confidence.

Families in Live Oak work with us because we offer broad market access and personalized support throughout the entire insurance process.

What sets us apart:

We believe insurance should give you confidence, not confusion. Our job is to guide you, protect your home like it is our own, and make the coverage process feel simple from start to finish.

– Richey Insurance Agency

We keep the quoting and review process simple. Homeowners in Live Oak follow the same three-step approach used by our clients across Texas.

Tell us about your home: Share basic details such as square footage, roof age, and the type of coverage you want.

We compare rates from 100+ carriers: You receive options from a broad network of A-rated insurance companies.

Choose a policy and get ongoing support: We stay available for renewals, coverage updates, and help during claims.

Saving on home insurance often comes down to selecting the right combination of coverage, upgrades, and discounts. The strategies below apply to households throughout Texas, including those in Live Oak.

Common ways to reduce costs:

These steps help keep your policy affordable without sacrificing key protections.

Texas does not require home insurance by law. Mortgage lenders usually require a policy to protect the property while the loan is active. Even without a loan, we strongly recommend keeping a policy in place because unexpected damage creates high repair bills.

We often hear from homeowners who planned to delay coverage but ended up facing a weather event soon after. A solid policy helps avoid that kind of financial pressure.

Roof condition plays a major role in pricing. Older roofs have more wear, which increases the chance of leaks or damage from hail and wind. A newer roof often qualifies for more competitive rates.

From our experience, one of the fastest ways a homeowner in Live Oak lowers their premium is through a roof update or repair. We guide clients through the rating impact so they know what to expect before and after making changes.

Yes. Many carriers reward households that place both policies with the same company. Bundling cuts costs for many of our clients, and it simplifies billing and paperwork. We have seen bundles reduce annual spending in a noticeable way, especially for families with multiple vehicles.

Most Texas homeowners carry an HO-3 policy, which fits the needs of many households. Some prefer an HO-5 for broader protection on both the home and personal belongings. During the quoting process, we review the differences so you feel confident choosing a plan that matches your comfort level.

Some of our clients decide to upgrade after seeing how much more an HO-5 covers, while others stay with the HO-3 because it fits their budget and coverage goals.

Most quotes are available the same day. In many cases, we prepare options within minutes once we have your basic home information.

Our team knows that timing matters, especially after storms or during real estate closings, so we work quickly while still reviewing all carrier options to help you get the best price.

Request a free quote using our convenient online form

Prefer to talk to a representative? Our agents are more than happy to help you.

You are welcome to visit our office. We are open Monday - Friday (8 am - 5 pm)