Speak To Our Experts

Flexible, Budget-Friendly Coverage from Over 100 Trusted Providers

“Richey Insurance Agency works for you, not just one insurance agency!”

Trustindex verifies that the original source of the review is Google. We have worked with this insurance company for over 10 years. They have consistently provided reliable coverage, responsive service, and clear guidance when we’ve needed it most. We appreciate the long-term relationship and professionalism.Posted onTrustindex verifies that the original source of the review is Google. Mr. Paul was very helpful in meeting my insurance needs. Also their price was less than what was quoted by other agentsPosted onTrustindex verifies that the original source of the review is Google. Respectful and courteous! Meets all demands and questions. Very cooperative. Paul is very easy to work with. Thank you guys!Posted onTrustindex verifies that the original source of the review is Google. Paul was very kind and very helpfulPosted onTrustindex verifies that the original source of the review is Google. Richey Insurance is the best!!!Posted onTrustindex verifies that the original source of the review is Google. Great service

It only takes a few moments to complete the form, request a quote now!

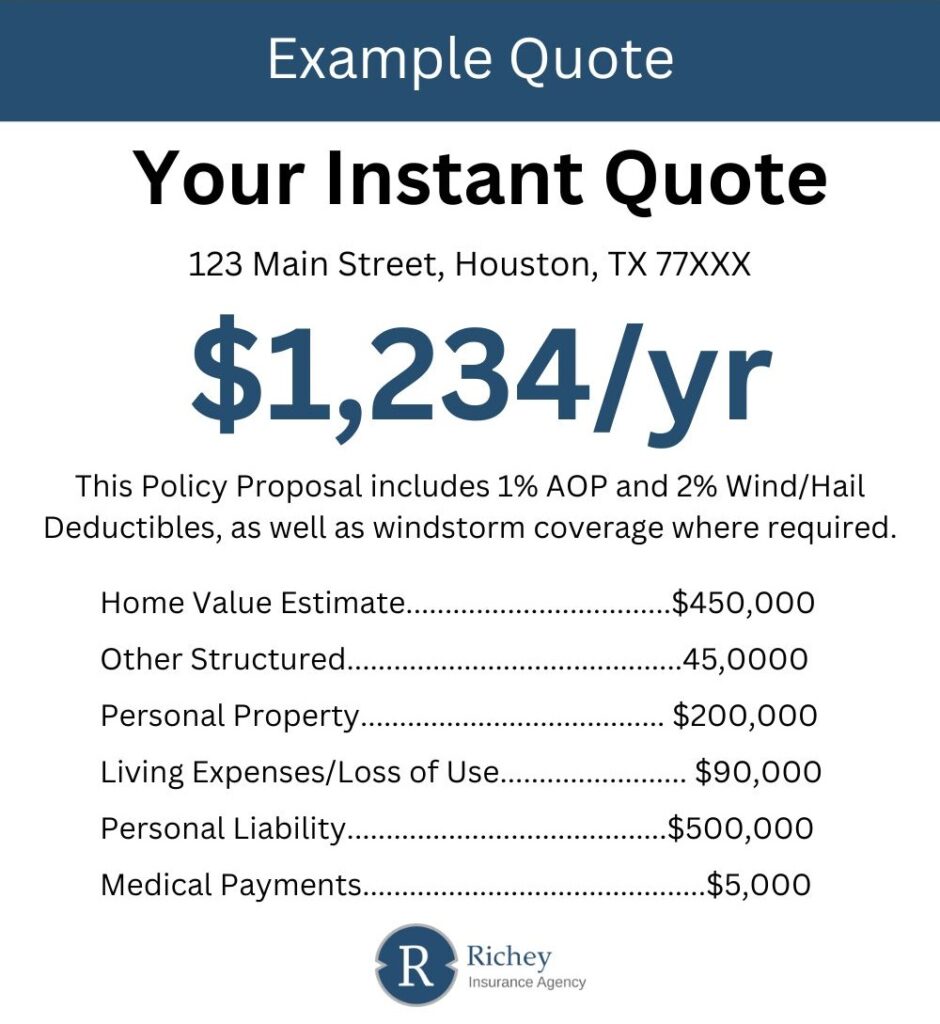

The image provided is a representation of what your quote will look like.

Homeowners insurance protects one of your biggest investments your home from unexpected loss or damage. A single event, like a fire, storm, or break-in, can lead to major repair and replacement costs. With the right policy, those expenses don’t have to come entirely out of pocket.

In addition to property protection, home insurance covers liability if someone is injured on your property and helps replace personal belongings that are stolen or damaged. Most mortgage lenders require homeowners insurance as a condition of the loan, but even if your home is fully paid off, having a policy in place keeps your finances protected.

Keep in mind that home insurance is meant for sudden or accidental events, not gradual wear or maintenance issues. Knowing what your policy includes and excludes helps avoid surprises during a claim. In Mansfield, TX where hail, high winds, and unpredictable weather are common having solid coverage adds an extra layer of peace of mind.

Yes. Fire damage is one of the primary perils covered under most standard home insurance policies. Your coverage can help pay for repairs, replacement costs, and temporary living expenses if your home becomes uninhabitable.

If you own your home outright, you’re typically allowed to handle repairs yourself. However, if you have a mortgage, your lender might require a licensed professional to complete the work, depending on the scope of damage and cost.

Homeowners insurance isn’t mandated by law, but mortgage lenders often make it a condition of financing. Even for paid-off homes, going without coverage leaves you exposed to costly risks from property damage or liability claims.

Several factors influence your premium, including your home’s age, construction materials, roof condition, and location. Weather exposure to hail or wind, proximity to fire services, and your selected coverage limits also play a part in pricing.

Gradual settling or wear-related foundation issues are typically excluded. However, if the damage stems from a covered peril such as a plumbing leak, you may be protected especially if your policy includes a foundation water damage endorsement.

Request a free quote using our convenient online form

Prefer to talk to a representative? Our agents are more than happy to help you.

You are welcome to visit our office. We are open Monday - Friday (8 am - 5 pm)